How To Sell a Winner

A proverbial question with no perfect answer

Today, more than at any other time in my career, I encounter investors with huge, life-changing returns in single stock positions. This comes as no surprise to anyone who has been paying attention to the US stock market over the past 15 years. Stock market returns are trending well above long-term averages. Further, the concentration of outsized returns among a small, well-known group of stocks is mind-blowing.

I have characterized the post-GFC US stock market as the easiest DIY market of all time. This summer, as a client walked me through positions in a self-directed trading account, I commented, “Yes, there is no denying that the stocks you hear about on financial television are the ones that have beaten the market in recent years.” This has been an era in which amateurs have been able to beat professionals. Perhaps the ubiquitousness of information and data has forever changed the dynamics of investing.

Which brings me to the question in the title of this post. How does one sell an astronomical winner? Rather than providing a black-and-white answer, I have developed a framework, albeit an imperfect one, for approaching this decision. With the 20/20 benefit of hindsight, we can always lament what ‘could have been’ had we YOLO’d our winners into the stratosphere. Selling winners relies more on emotion than on data and analysis.

There are three paths forward.

Never Sell - YOLO

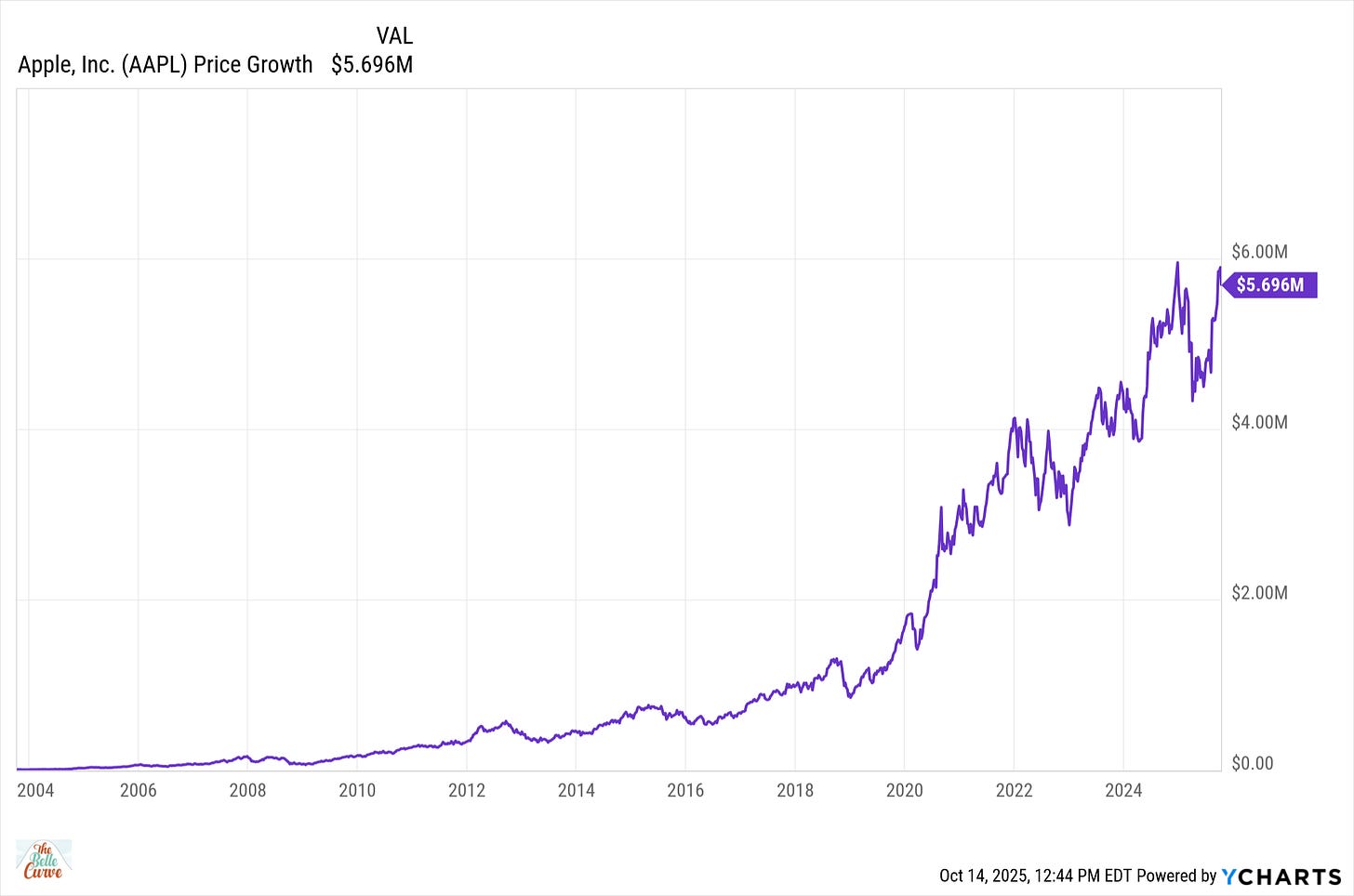

If I had bought $10,000 of Apple Inc. stock in 2003, when I graduated from college and never sold a single share, that investment would be worth $5.6 million today. Gulp! (I actually had $15,000 left in my college savings account at the time. Too bad I spent it on a move to New York City.) But many investors have held onto Apple stock during this time period.

In most of these real-life cases, Apple makes up a large percentage of the investor’s portfolio. Never selling has been a winning strategy so far. One option, therefore, is never to sell. Avoiding the decision completely ensures two things:

1. The investor will not miss a cent of potential future returns from Apple, and

2. The performance of a single stock will forever dominate the portfolio.

I am personally uncomfortable with betting my financial future on one company, even a great one like Apple. But for some, the mental fortitude of jumping off the winning ride is too great. To them I ask, then what are these life-changing investment returns for? Is it all just a game, a thrill-seeking ride to watch numbers go up on a screen? If that is the goal, by all means, keep playing. But don’t be surprised when the future doesn’t perfectly match the past.

Rip the Band-Aid

A second extreme option is to rip off the proverbial band-aid and sell every share at once. You remember the anxiety-inducing exercise of removing sticky band-aids from your scabs as a child. Removing them slowly is both mentally and physically too painful. Best to get it over with and rip it off. After the scream, you breathe a sigh of relief. It wasn’t so bad after all.

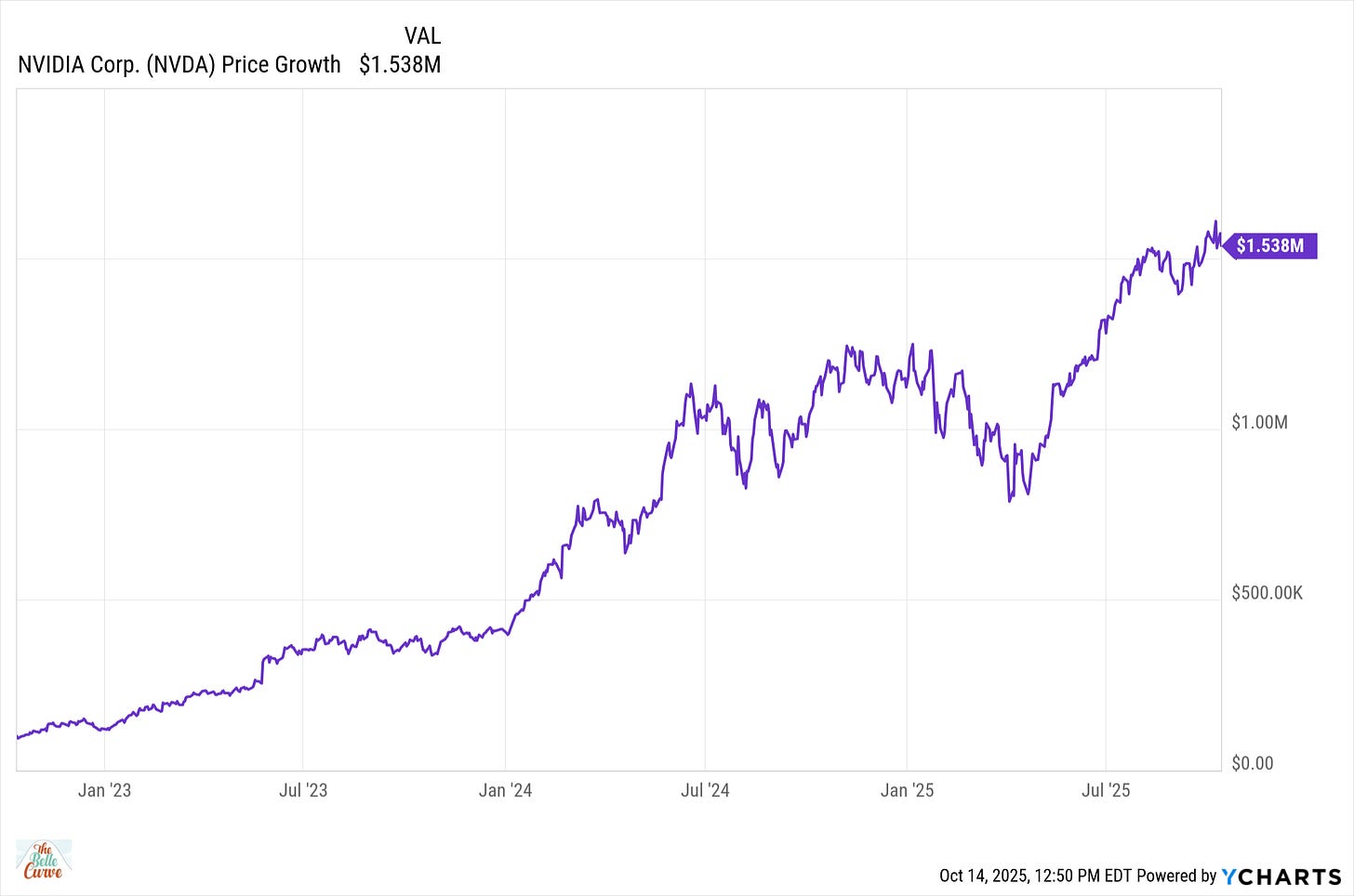

Ripping the band-aid is a strategy that makes more sense for short-term extreme winners. Consider the $100,000 investment made in shares of NVIDIA Corp that is suddenly worth over $1.5 million. This, too, is a common spot for many investors.

NVIDIA's stock has declined by more than 50% on two occasions over the past decade. Do you have the stomach to watch $100,000 become $1.5 million and then drop to $750,000? Or are you someone who would rather enjoy the things your newfound gains can buy for you? The first rule of selling a winner is, “Know Thyself”.

The surest way to lock in a gain is to sell it all. But on this path, you must also agree to never look back at what could have been if NVDA stock triples again over the next 5 years.

The Middle Path - A Planned Exit

To most investors, the first two options are both insufferable. We have decent calculators inside our monkey brains, and we like to keep score. We know that the future path of the stock is likely neither straight up nor straight down. In many cases, taxes also need to be taken into account. However, the murky middle option contradicts our desire for clarity and a known outcome. This is where investors often get stuck. How do I sell a small portion of my winner, gradually, over time? Our minds can imagine so many possible scenarios that we freeze, like deer in headlights.

To those stuck in the middle, I offer an imperfect framework for selling winners methodically over time.

Calendar-based percentages.

Pick a percentage of the total position you want to sell and decide on what cadence to sell shares. For example, you could sell 25% every 3 months and completely exit the position within a year. If you want to split the tax bill on the gain over multiple years, be sure to straddle some of your trades across the turn of the calendar year. This time of year is perfect for embarking on a tax-straddling plan. You can sell shares in October and again in January, less than three months from now, and the taxes are due in April 2026 and April 2027. (This is not tax advice. You should consult your CPA.)

Want to take it slow? No problem. Sell 10% of your position every January or 5% on the 1st of each month for the next two years. The possibilities are endless.

The key to success with this strategy is to determine a suitable cadence and commit to the timeline. You cannot let the stock price sway your commitment to the plan, no matter whether it goes up or down. One factor is always unknown: the price of the stock tomorrow, next month, or next year. If sticking to the plan is difficult for you, consider Option 1 or Option 2 discussed earlier.

If you’ve read this far, you likely have a winner in your portfolio, a stock that has appreciated beyond your wildest dreams. You have already won. Congratulations! The key to determining your exit strategy is straightforward.

Ask yourself: What would I regret the most? Losing my gains by holding on too long or missing out on more gains by selling too early. If you react strongly to either question, you should consider options 2 or 1: Ripping the Band-Aid or Never Sell. But if you feel a mix of emotions, you may find yourself Stuck in the Middle. The best thing you can do is to develop a plan to sell over time and to commit wholeheartedly to executing it. Your success is not predicated on selling the stock at the absolute top. That’s practically impossible. All you need to do is decide when and how to get off the train.

Thank you for posting your thoughts.

I wrote a complete book - The Intelligent Investor's Art of Selling. You might be interested in - https://www.amazon.in/dp/B0DMFJW3PV