What if there was a global fiduciary standard?

What if the whole world operated under a Fiduciary Standard? That’s George Kinder's question in his latest book, The Three Domains of Freedom.

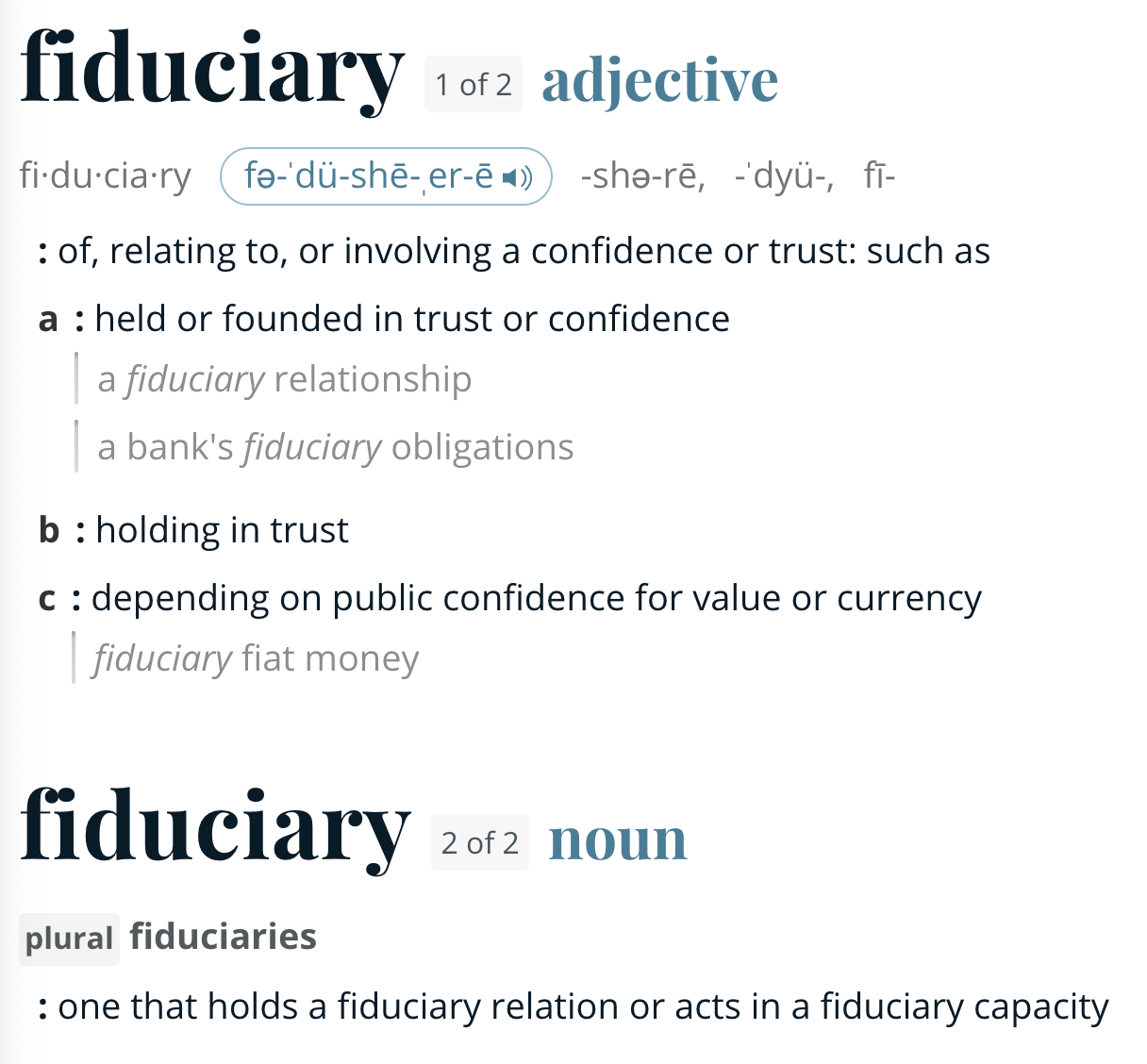

The term " fiduciary" is not well-known in the general population, but independent financial advisers have tried (unsuccessfully IMO) to explain it to investors. Here is the definition per Merriam-Webster:

Confidence and trust are powerful words. What would it be like if we could have trust and confidence in all of the dealings of day-to-day life? What if we held our institutions - companies, governments, and nonprofits - to this standard?

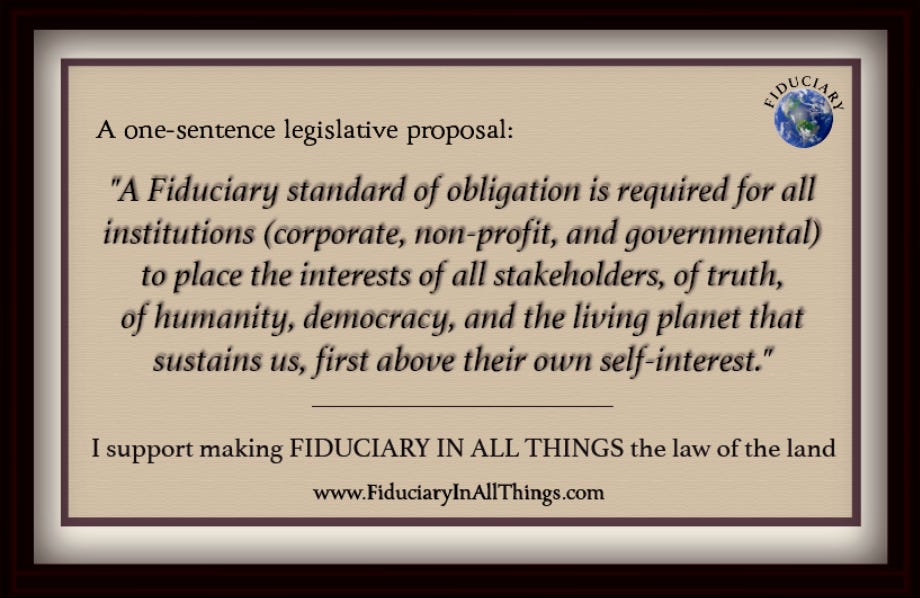

It may sound very pie in the sky or unrealistic, but Kinder suggests it might be easy. All we have to do is adopt a one-sentence legislative proposal.

You may be thinking this all sounds very pie-in-the-sky or kumbaya. But let’s talk about what this standard would mean and, more importantly, how it differs from how the world operates today, at least in developed, democratic economies.

Corporations are legal entities established and authorized by the state to conduct commerce. Their owners are shareholders entitled to share in the entity's profits. In the United States and most developed economies, corporations have a duty solely to maximize profits for their shareholders. And boy, have they done a great job maximizing those profits, especially in the US.

This shareholder-centric system ensures that companies produce the products and services most desired by customers. Look around you and see some of modern capitalism’s greatest accomplishments. You’re likely using one of them to read this blog post. Humans are healthier, more prosperous, free, and comfortable than at any other time in history.

But arguably, something is missing: a broader viewpoint of the corporation’s impact outside of its narrow focus. Specialization has led to our greatest discoveries, but the current economic model lacks an overarching theme to protect and strengthen the whole.

Cigarette companies are the perfect example. They produce a simple product highly desired by their customers, made from the easy-to-grow tobacco plant. The profit margins are high, and customers are continuous and loyal. What, then, were tobacco corporations to do in the face of mounting scientific evidence that their products increase the risk of cancer and early morbidity? Let’s review the shareholder model.

If the duty is solely to shareholders, tobacco companies should ignore the scientific evidence and continue to sell as many cigarettes to as many customers as possible. This is precisely what tobacco companies did for decades, even willfully misleading their customers that smoking was not harmful, until the Master Settlement Agreement between 45 tobacco companies and 52 US states and territories was reached in 1998.

How would this be different under a Fiduciary Model? Tobacco companies would owe a duty to customers, employees, the public, and shareholders. They are more likely to be honest about the risks of using their products. They are less likely to try to advertise to children not mature enough to understand the risks. This sacrifice of a portion of profits in the short run builds trust that can lead to more informed and loyal customers in the long-run. The Fiduciary Model works as a natural suppressant to the extremes of capitalism.

Cigarettes are easy to pick on because the health risks are now accepted universally. Imagine if we could trust the information we receive from corporations? Now, apply this mental exercise to governmental institutions, non-profits, and the media.*

Imagine a fiduciary standard for elected officials, rather than the current system (in the US, at least) of allegiance to the largest donors or political party affiliation. The first order of business would be to restrict members of Congress from trading individual stocks when they clearly have inside information.

I’ve barely scratched the surface of this argument, but I hope your creative juices are flowing. We CAN improve our current systems and structures because we are in charge. All it takes is the collective will and desire to do so.

I choose to work under a fiduciary standard model because trust and confidence are necessary to assist people with their most important financial decisions. How could I be effective without it? This is how I know that applying a fiduciary standard more broadly will be a major, positive step forward for the world.

*The US had a robust system of journalistic integrity for many decades, before the rise of 24/7 cable entertainment ‘news’, social media, bloggers (guilty as charged), and modern-day influencers.

Superb, and fully agree! One fine-tuning to explore in dialogue: because of legal personhood, investors only have rights to a share of equity and a share of vote - which is distinct to turning legal personhood (the space in law of rights and obligations) to legal thinghood, the space of property.

This perspective opens a lot of space to make FIAT solid in governance structures, by including all stakeholders in voting rights independent on their financial relationship.

Enjoy your perspective. Would have loved to see you have this discussion with Milton Friedman (am sure you've seen his Free to Choose videos/book).