This Will Probably End Badly

Buy the Dip and the Megacap Trend is too long in the tooth

I was shocked by the US stock market’s bounce back from the “Liberation Day” tariff announcement.

But I shouldn’t be shocked.

Investors are conditioned to “Buy the Dip” because it’s been working for a very long time. More specifically, buy huge, mega-cap tech companies that have dominated the market since the end of the financial crisis 16 years ago.

The Magnificent 7 - Microsoft, Amazon, Facebook, Apple, Google, Nvidia, and Tesla - now comprise 30% of the S&P 500 and 41% of the Nasdaq 100. They used to be called the FANGs, FAANGs, FANMAGs, and now the Mag 7. Wall Street loves an acronym. These seven companies have a combined market cap of $16.8 trillion. This is roughly equal to the entire market cap of Europe and the United Kingdom and larger than that of China, the world’s second-largest economy.

Many (including me!) have predicted the end of the Magnificent 7’s dominance, and they have been wrong. I’m not here to do that today, but to observe that a trend this long in the tooth will likely end badly.

This thought occurred to me as I attended a brain trust session hosted by my friend JC Parets of All Star Charts in New Orleans last week. In a room full of serious traders, squished between presentations on crypto and gold, a fellow wealth advisor, Stephen Weitzel, presented his whitepaper titled, Pavlov’s New Dog. He made the case that investors, like the dogs in Pavlov’s experiments, have been conditioned to overweight US stocks. He asked, “What will it take to break this conditioning?” How many times will Pavlov have to ring the bell and not provide food for the dogs to stop salivating at the sound?

Investors have been rewarded immensely for buying the dips, overweighting US stocks, and concentrating their portfolios in a handful of gigantic tech stocks. I have seen it first-hand. The 2,000% gain in Apple that allowed a client to retire earlier and spend more than she ever expected. The $500,000 dollar investment in Nvidia that turned into $4 million. Statements showing enormous unrealized gains and heavy concentration in these beloved names.

The average annual return for the S&P 500 from 2010 to 2024 was almost 13%—18 % for the NASDAQ 100. These have been glorious years to invest in large-cap US growth stocks. Given the long-term average for stock market returns (8-10% per year), these returns were more than our wildest dreams. Yay!

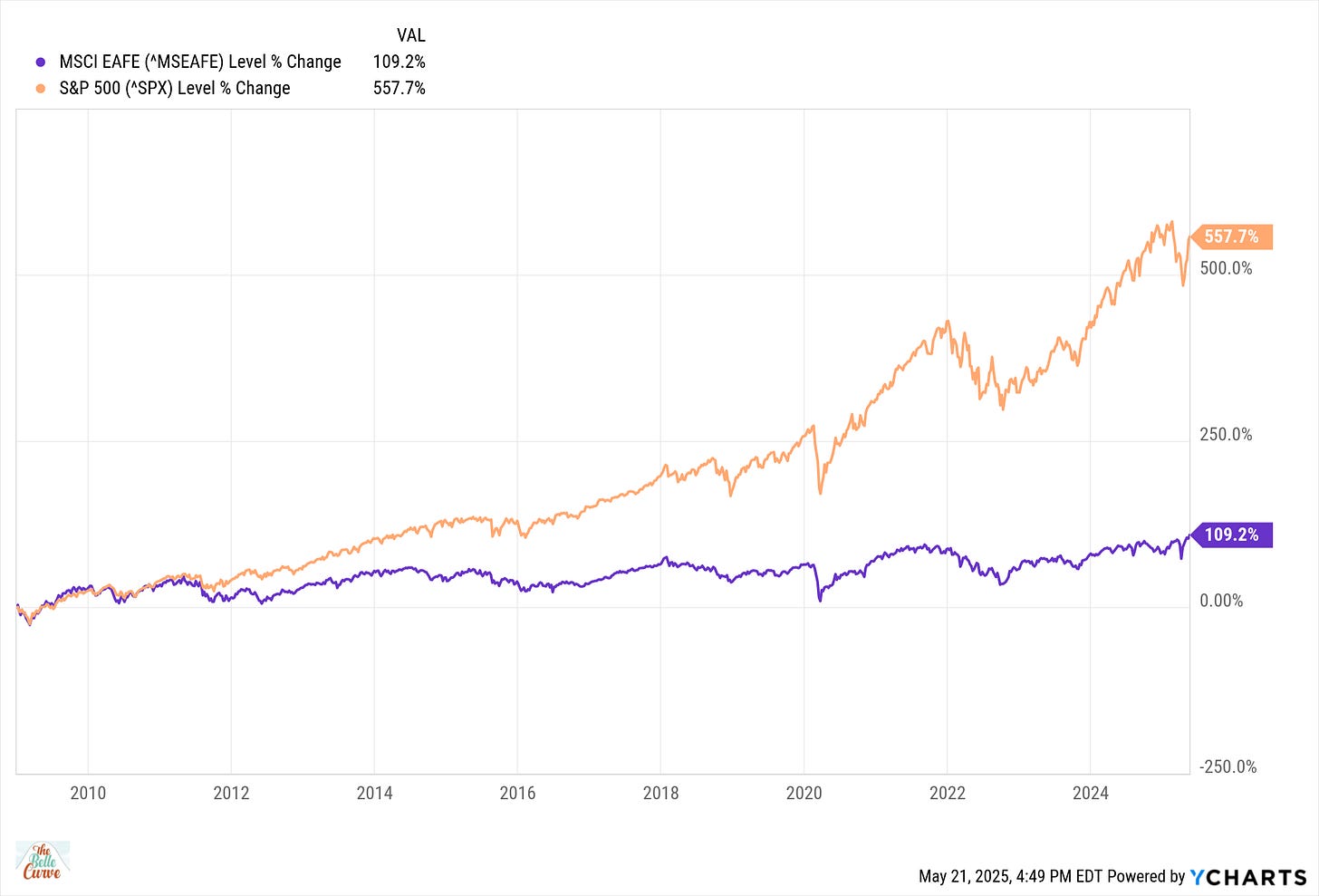

A force similar to gravity exists in financial markets. Some use the popular analogy — Stock markets take the stairs up and the elevator down. Similarly, trends have a tendency to revert to the mean. The US stock market has outperformed stocks in developed countries around the world by to the tune of 4x since the Great Financial Crisis. International stocks were the most hated asset class by the end of last year.

Take a look at the performance of these markets so far in 2025. International stocks are crushing US stocks, and it’s not even close.

This is a stunning performance differential —almost 1500 basis points, and I doubt most people have even noticed. Is this the beginning of a trend reversal? I don’t know. But it proves that we should always expect the unexpected.

What will it take to change the knee-jerk reaction of investors to keep buying the dips in these megacap companies? How many times will Pavlov have to ring the bell? It’s an interesting question that gives me the chills. My gut reaction is that it will take A LOT of pain to break this habit.

In 2022, many Magnificent 7 stocks were cut in half or worse. And yet, investors were rewarded almost immediately for buying these declines or riding them out. Based on this evidence alone, we know the pain will have to be more severe or last longer to shake this trend.

I take no pleasure in pointing this out, and I have no predictions for how or when this trend will end. But all things do come to an end.

It doesn’t have to be a big, dramatic crash. Perhaps these giants will grow more slowly, and other stocks will catch up and surpass them. Like the tortoise and the hare, investors probably won’t notice until it’s too late.

The challenge with investing trends is that they can last longer than anyone expects. But if you have been blessed with some of these outsized gains, be sure to make an offering to the stock market gods. Then take some money off the table, diversify, and live to see the following change in trend. I don’t know if this is the 7th inning or the bottom of the 9th. It feels like a marathon extra-inning game to me.

Charles Ellis wrote a book that changed my entire philosophy on investing called Winning the Loser’s Game. The key to long-term success in investing is to reduce unnecessary mistakes. Doubling down forever on US large cap stocks is an unforced error waiting to happen. My guess is that this will probably end badly.

Do you have a suggestion of what to do instead?

Nice post! Food for thought - US exceptionalism has become a bit of a narrative. The immediate underpinning trend in my view is that of fundamentals: real earnings per share (and its drivers return on equity, margins - especially free cash flow generation - and growth). And the payouts - dividends plus buybacks. US edges out Europe and Japan on ROE 19% to 14% and 10% over the last four trailing quarters. Policy changes have created uncertainty, but not as much for the companies driving these region level fundamentals. It will be interesting to see if the relative International performance persist! :)